15/03/2018

Are you going to buy a house? You must allocate between 10% and 13% of the price of this in terms of taxes and fees. This will depend on certain aspects that we will explain to you.

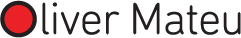

Notary

Notary expenses are those that occur when the public deed of purchase-sale is granted. The cost is set by regulations and are called notarial fees. For public housing and subrogations a reduction is applied. Here is an infographic with the estimated costs.

Land Registry

These fees generate when the purchase-sale is registered at he Land Registry. They are also fixed by regulations and their amount depends on the price of the property. There are variations that modify the general rules. Thus, for example, changes apply to public housing, mountain land or farm land.

Lawyer

If a lawyer is hired, a approximate 1% of the value of the purchase will be the amount to be charged as fee. This is an estimated sum that can vary depending on the hired professional.

Taxes on new construction housing

IVA

Currently, a rate of 10% of the sale price is applied.

AJD (Documented Legal Acts):

The purchase and sale of new construction housing and parkings are taxed with this tax, as well as regular IVA. The tax rate applicable in the Balearics is a 1.5%.

Taxes on second-hand housing

ITP (Patrimonial Transfer Tax)

It applies instead of regular IVA when buying second-hand homes. In the Balearic it is between 8% and 13% depending on the amount of the purchase. There are also reduced rates for some cases (public housing, large families, young people ...). In the case of the acquisition of a first home of less than €270,000, a tax rate of 4% will be applied. In addition, since July 2023, a reduced tax rate of 2% is applied to the acquisition of properties that constitute the buyer's main residence, provided that, in addition to the aforementioned conditions, any of the following circumstances apply:

a) The buyer is under 36 years of age and the property is also the buyer's first home.

b) The buyer is entitled to the minimum disability tax for ascendants or descendants in the IRPF corresponding to the last tax period for which the tax return period has ended.

Other taxes

Municipal capital gain

The municipal capital gain (not to be confused with the tax surplus) is the municipal tax on the increase in the value of land of an urban nature and is calculated based on two assumptions: Real method: the acquisition and transfer prices are considered, taking into account the proportion of land in the cadastral value at the date of accrual. Objective method: the cadastral value and the coefficient determined by law are taken into account, depending on the period of time that has elapsed in the acquisition and transfer. The cadastral value is calculated by adding the cadastral value to the number of years that the seller has owned the property (a maximum of 20 years is taken into account). It must be settled at the town hall within 30 calendar days from the date of the deed.

Mortgage

In the event of having to apply for a mortgage to purchase the house, the buyer will have to pay the valuation but all other associated costs (taxes, notary, registry) will be met by the bank that grants the mortgage loan.

AJD (Documented Legal Acts):

If there are mortgage loans, donations and other cases, this tax is applied. The tax rate applicable in the Balearics is 1.5%.